Introduction to Fundamental Analysis in Forex

Fundamental analysis in forex is a method of evaluating currencies by examining economic indicators like interest rates, GDP, and inflation. Learn the 6 key factors that move currency prices and how to use them in your trading.

What is Fundamental Analysis in Forex?

Fundamental analysis in forex is a method of evaluating currencies by examining the economic, political, and social factors that influence their value. Unlike technical analysis which studies price charts and patterns, fundamental analysis answers the question: why is a currency strong or weak?

The core principle is simple: currencies reflect the health of their underlying economy. A growing economy with rising interest rates attracts foreign investment, which increases demand for that currency. Fundamental analysis helps traders identify which currencies are likely to strengthen or weaken over time based on economic data.

Fundamental vs Technical Analysis

| Fundamental | Technical |

|---|---|

| Why price moves | Where price might go |

| Economic data & news | Charts & patterns |

| Sets direction | Improves timing |

Most successful traders combine both: fundamentals to determine which direction to trade, technicals to find optimal entry and exit points.

Key Factors That Move Currencies

1. Interest Rates (Most Important)

Higher interest rates attract foreign capital seeking better returns → more demand for the currency → stronger currency. This principle is the foundation of the carry trade strategy.

What to Watch

Central bank rate decisions, forward guidance, and how inflation compares to the bank's target. Learn more about how the Fed communicates in our Dot Plot guide.

2. GDP Growth

Strong economic output signals a healthy economy, increasing demand for its currency. When comparing currency pairs, look at the relative growth rates between countries.

3. Employment Data

A key indicator of economic health. The US Non-Farm Payrolls (NFP) report is widely regarded as the most market-moving monthly release, often causing significant volatility in USD pairs.

4. Inflation

The relationship between inflation and currency strength depends on how central banks respond:

- High inflation → central bank may raise rates to cool the economy → currency strengthens

- Low inflation → central bank may cut rates to stimulate growth → currency weakens

Note: Markets react to expectations. If a rate hike is already "priced in," the actual announcement may have little effect.

5. Trade Balance

- Trade surplus (exports > imports) → foreign demand for the currency increases → stronger currency

- Trade deficit (imports > exports) → more currency flows out → weaker currency

6. Political & Geopolitical Factors

Elections, policy changes, geopolitical tensions, and unexpected events can cause sudden volatility. Stability tends to support a currency; uncertainty weakens it.

The Challenge for Retail Traders

Proper fundamental analysis requires tracking:

- Economic calendars across 8+ countries

- Central bank statements and speeches

- Dozens of monthly indicators

- Breaking news and shifting sentiment

- Institutional positioning via CoT reports

This is time-consuming. Institutional traders have dedicated research teams. Most retail traders don't have 2-3 hours daily to stay on top of everything.

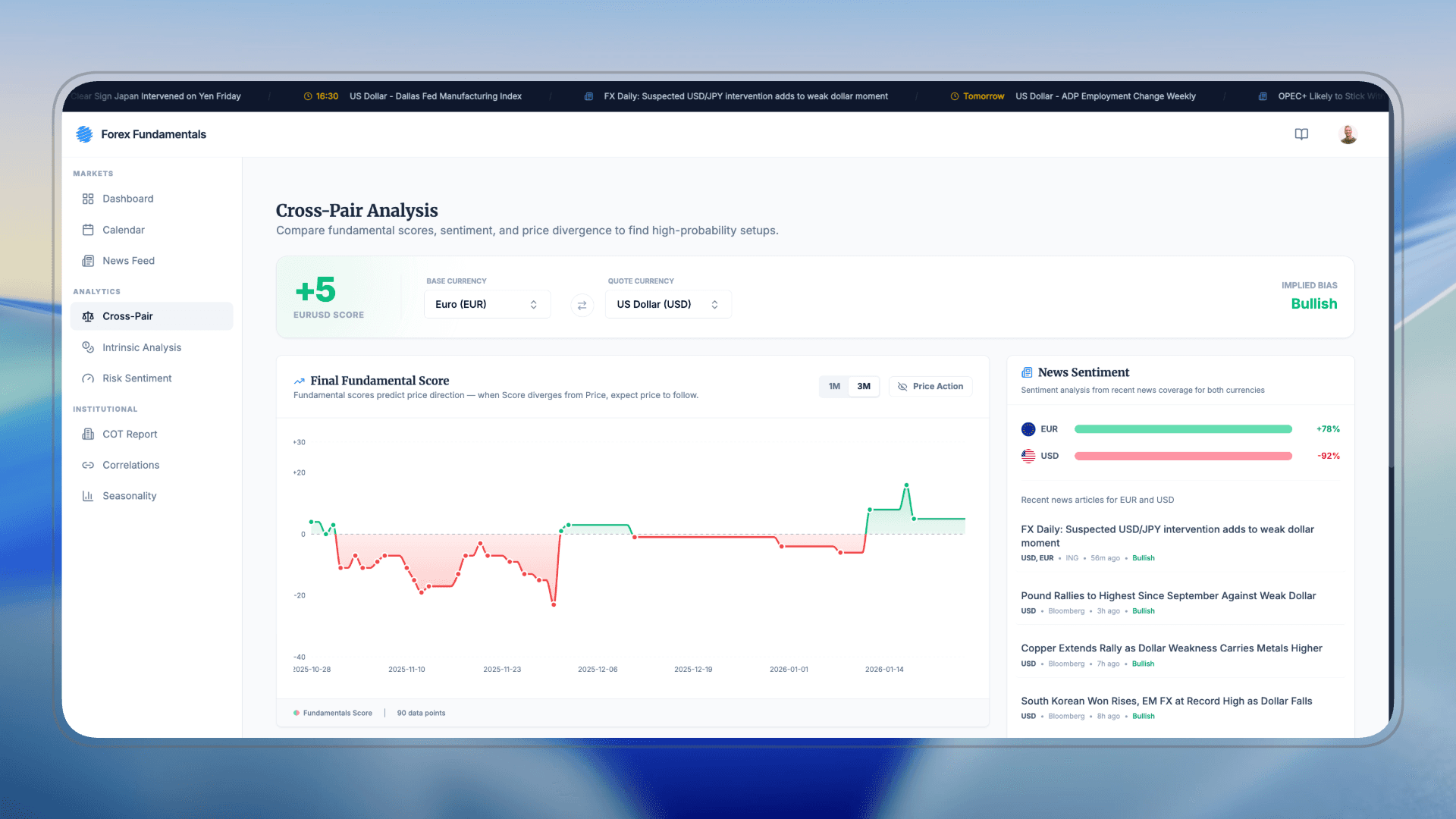

A Practical Solution: Forex Fundamentals Platform

Instead of spending hours on manual tracking, Forex Fundamentals automates the heavy lifting and presents everything in a clear, actionable format.

Currency Bias Scores

We aggregate economic data, central bank policy, and market conditions into a single fundamental score per currency. At a glance, you can see which currencies are fundamentally strong, neutral, or weak:

With this view, you can quickly identify which currencies are fundamentally strong or weak — pairing strength against weakness for data-driven trade ideas.

Real-Time Sentiment Analysis

Fundamentals tell you what should happen. Sentiment tells you when the market is ready to move. Our platform monitors news flow, central bank communications, and market commentary to give you a real-time sentiment reading for each currency. When sentiment aligns with fundamentals, you have a high-conviction setup.

Economic Calendar with Context

Most economic calendars just list events. Ours shows you why each release matters and how it fits into the bigger picture. Before NFP, you'll know what the market expects, what would be a surprise, and how it could shift USD bias.

The Bottom Line

Our platform calculates currency scores automatically, tracks sentiment in real-time, and alerts you when fundamentals shift — so you can focus on trading, not research.

How to Apply Fundamental Analysis

- Build your bias per currency — Analyze each currency individually. Is USD bullish or bearish based on current fundamentals? What about EUR? Our platform gives you a fundamental score for each major currency, so you can quickly identify strength and weakness.

- Watch market sentiment — Fundamentals set the direction, but sentiment drives short-term moves. Track how the market is interpreting news and data releases. Our real-time sentiment indicators show you what traders are thinking right now.

- Look for trends in the data — One data point rarely changes the bigger picture. Is inflation trending higher over multiple months? Is employment consistently strong? Trends in economic data confirm or challenge your bias.

- Stay systematic — Don't react to every headline. Focus on high-impact events relevant to your pairs, and let a structured dashboard filter the noise for you.